PAN EU accounting — complex VAT compliance simply automated

With Amainvoice, you can keep track of your sales tax obligations across Europe. We automate your bookkeeping so you can focus on growing.

The challenges of PAN EU accounting for Amazon sellers

Storage and sales in up to seven European countries create new tax obligations with Amazon PAN EU. Without the right strategy, this can quickly lead to a bureaucratic nightmare. Hidden costs, missed deadlines and unclear processes are just a few of the hurdles that need to be overcome.

Complex sales tax in every warehouse country

Each pan-EU country has its own tax laws, reporting deadlines and reporting requirements, as does SAF-T in Poland. If you store goods abroad, you must submit local sales tax reports and often Intrastat reports there. Manually tracking these complex and country-specific obligations is extremely error-prone, time-consuming and a high risk.

Booking the automatic Shipments of goods

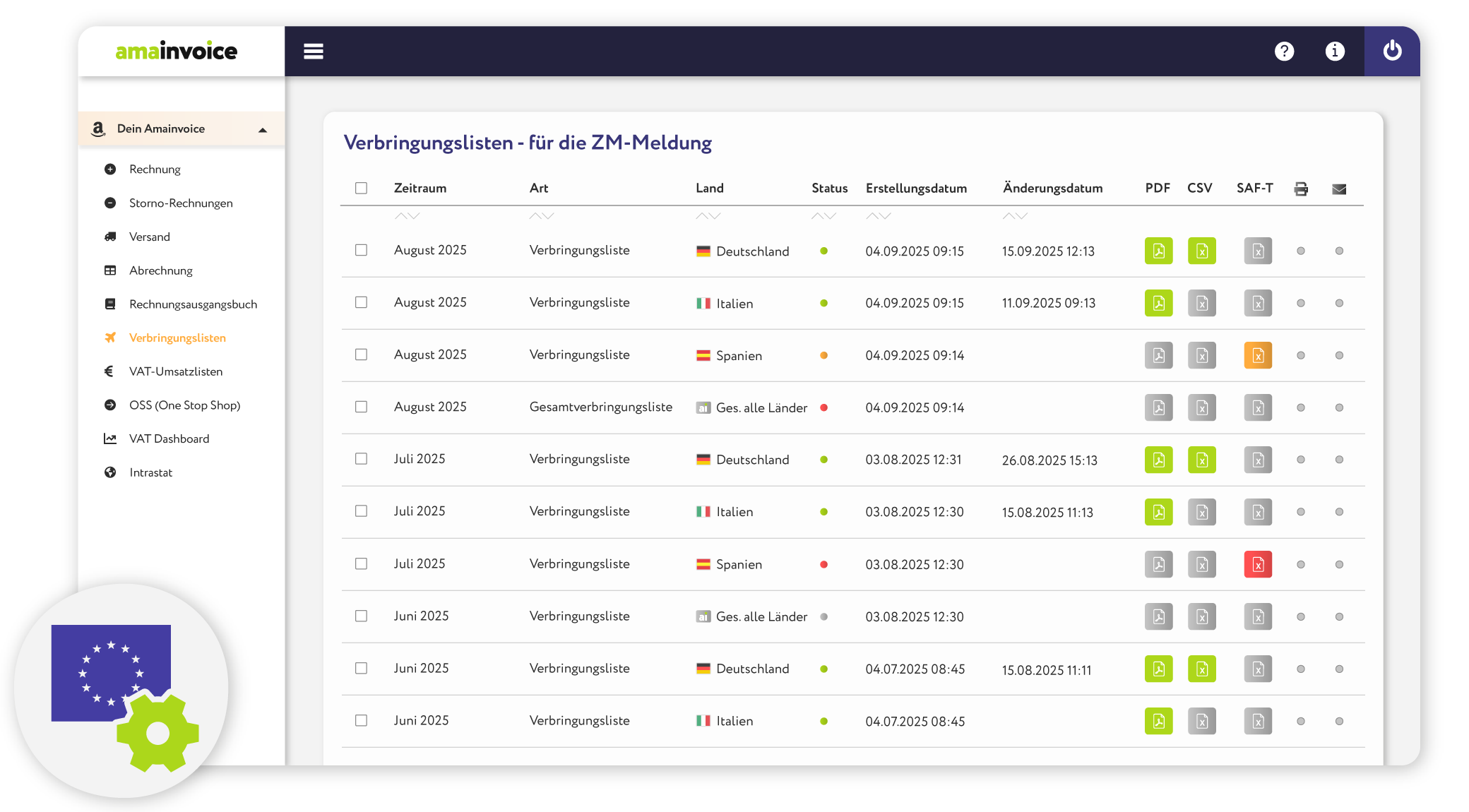

Amazon automatically moves your goods between warehouses in different EU countries in the pan-EU network. These movements of goods are regarded as “intra-community transfers” subject to sales tax and must be fully recorded in the accounts. Without an automated solution, it is almost impossible to correctly record these thousands of transactions.

Manual allocation of all Amazon receipts

The reports provided by Amazon are complex and cannot be used directly for accounting. Numerous individual transactions, ranging from sales, fees, FBA inventory costs to advertising expenditure, must be compiled from various sources and correctly attributed. Manually recording and assigning these documents from several countries is an enormous burden.

Amainvoice: Your ideal solution for PAN EU accounting

We automate the most complex aspects of PAN EU accounting and enable you to see all your tax-relevant data from Amazon in a single, clear dashboard. No more Excel chaos and manual data entry.

Automated data processing

Complete data collection

Amainvoice automatically imports all relevant data from Amazon, including sales, fees, returns and, above all, intra-community shipments. This gives you all receipts and information in one place.

Smart classification

Amainvoice correctly classifies every transaction according to national and international accounting standards, so that you always have an overview of your PAN EU sales.

Country-specific reports

Aminvoice creates tailor-made reports that exactly meet the requirements of the respective tax authorities in the various EU countries. These reports are optimized so that you or your tax advisor can submit sales tax returns quickly and without errors.

Perfect database for your bookkeeping

Complete and accurate data sets

Amainvoice ensures that all relevant booking data, from sales to Amazon fees and returns, is correctly recorded and assigned. You get clean, structured data sets that you can transfer directly to your accounting software or to your tax advisor, without manual rework.

Automated document preparation

All transactions are automatically linked to the appropriate documents and accounting records. This means that you always have a complete and comprehensible audit trail, which makes working with your tax advisor easier and ensures compliance.

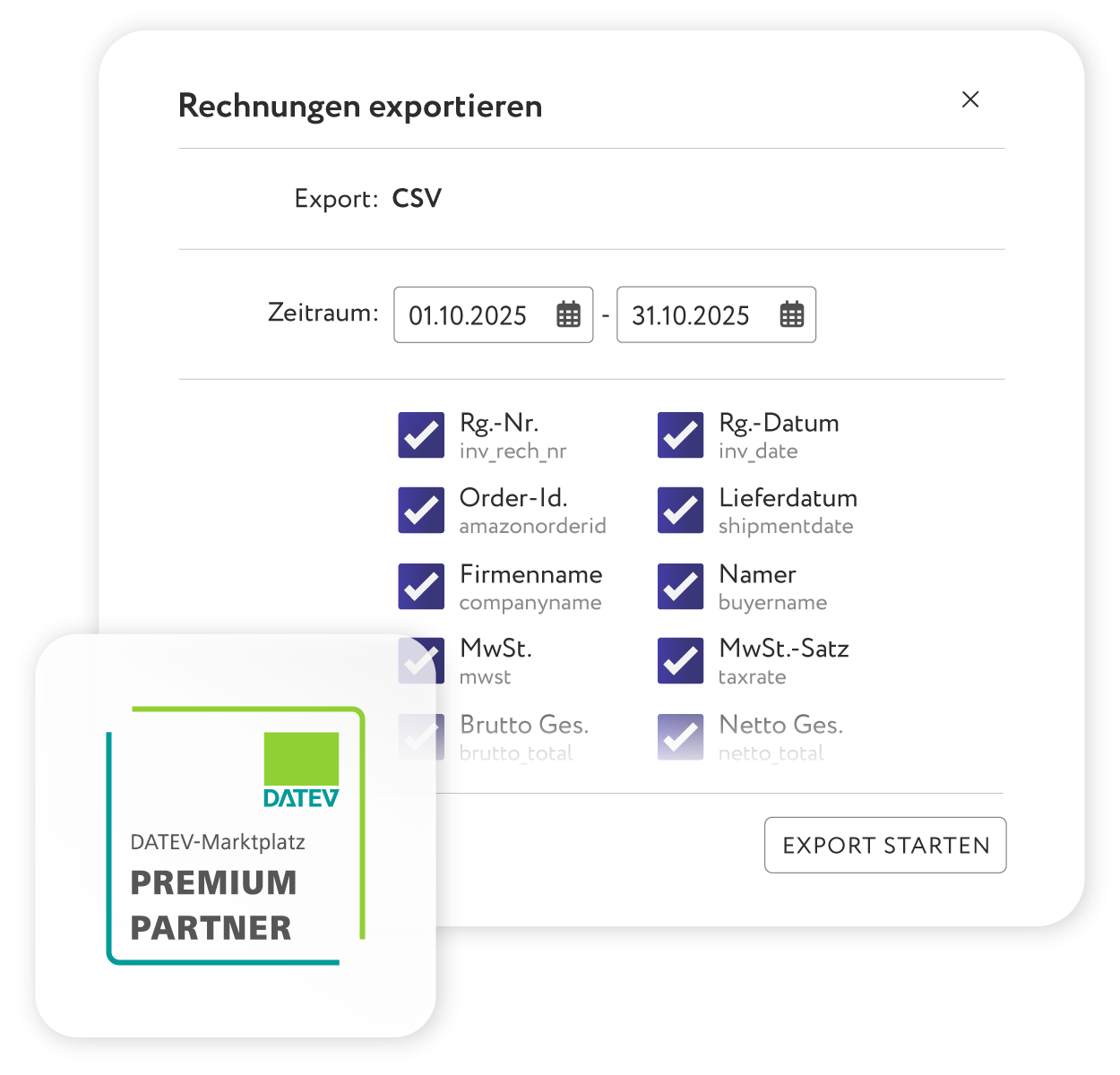

Export for common systems

With Amainvoice, you can export your prepared accounting data to all common formats such as DATEV or CSV at the push of a button. In this way, we guarantee a smooth process and seamless integration into your tax advisor's existing processes.

“For Amazon retailers, it is a challenge for bookkeeping to get the exact fees, income and tax rates. Amainvoice provides the necessary clarity — and automates exactly what otherwise costs hours. I recommend it to all retailers in my community. ”

Start Your 14 Day Trial Now - With No Obligations!

Other functional areas of Amainvoice

We comprehensively simplify your Amazon FBA accounting. Amainvoice reliably records and books all your sales, monthly FBA fees and returns, so you always have a full overview of your financial flows.

We also have a tailor-made solution for your FBM sales. We take care of the correct accounting of all your FBM transactions and ensure that your income and expenditure are correctly allocated.

We provide the perfect database for tax advisors. All Amazon accounting data is exported in common formats such as DATEV, which enormously speeds up the processing of client accounts and minimizes errors.

Error-Free Accounting — Completely Automatic

Common questions about Amazon PAN EU accounting with Amainvoice

What is PAN EU accounting and why is it so complex?

PAN EU accounting refers to the tax recording of sales and goods movements resulting from Amazon's PAN EU program. The complexity lies in the different sales tax laws, reporting deadlines and the need to correctly book intra-community shipments.

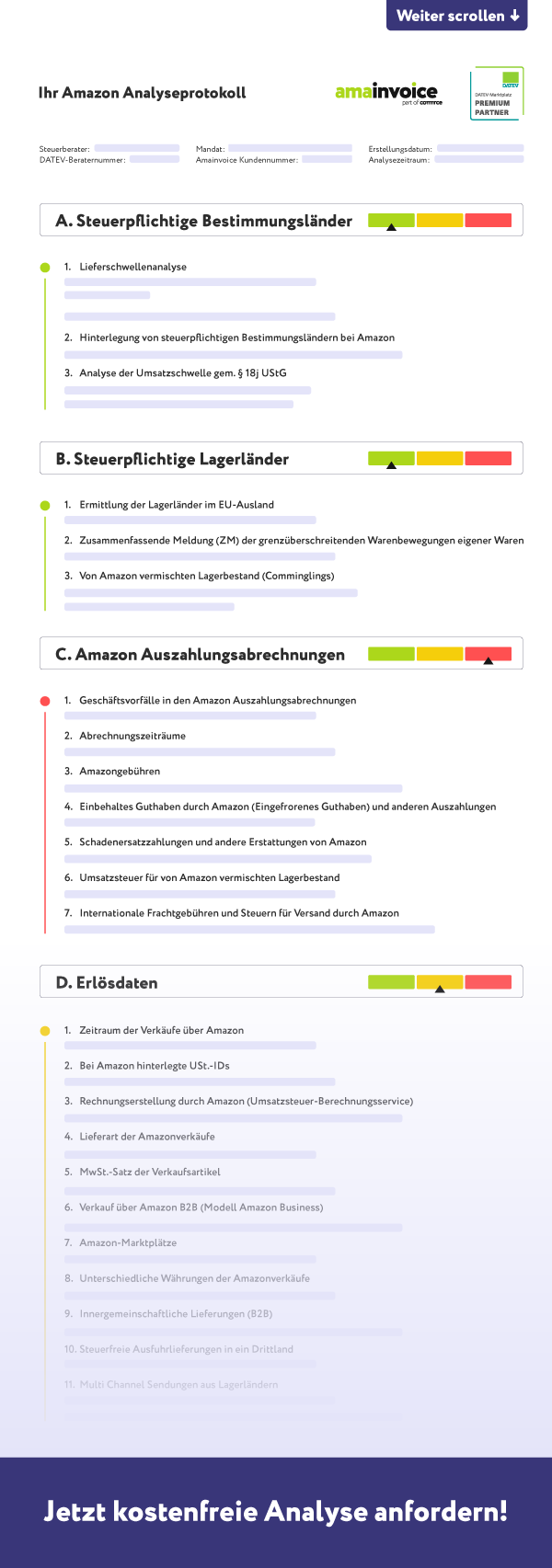

How does Amainvoice help me understand PAN EU taxes?

Amainvoice not only automates accounting, but also prepares all data in such a way that you get a clear overview of your tax liability per country. In this way, you can see exactly which transactions are taxable and where.

How does Pan EU accounting differ from normal FBA accounting?

PAN EU accounting also includes warehousing and sales in other EU countries (such as Poland, the Czech Republic) in addition to normal sales in Germany. This results in additional sales tax obligations in these countries.

Is Amainvoice also suitable for small Amazon retailers with PAN EU?

Yes, Amainvoice is ideal for small and medium-sized retailers in particular. We take the complexity out of PAN EU accounting so that you can fully focus on your growth without having to set up an expensive accounting team.

Get Started With Amainvoice Today

PAN EU accounting: Your way out of tax chaos

Die PAN EU accounting is a critical success factor for every Amazon retailer who uses the PAN EU program. With expansion into various European markets, not only do your sales grow, but also your accounting and tax obligations. Without the right strategy, the PAN EU accounting quickly become a confusing and time-consuming process that ties up your resources and keeps you away from your core business.

The biggest problem is intra-community shipments — i.e. the automatic transfer of your goods by Amazon to warehouses in:

- poland

- Czechia

- france

- spain

- italy

- slovakia

These goods movements are tax-relevant and must be precisely documented and mapped in your accounting department. Die PAN EU accounting It also requires the correct and timely submission of sales tax returns in the respective countries. Any mistake can result in expensive back payments or fines.

What Amainvoice can do for your Amazon PAN EU accounting:

Amainvoice is the solution that gets this chaos under control. Our specialized software is perfect for PAN EU accounting tailored. We automate the entire process: From importing all Amazon data — including goods movements that are difficult to record — to correct classification and preparation of the data for your tax advisor. With Amainvoice, the complex PAN EU accounting It's child's play. You get a transparent overview of your tax liability in every country and can rely on the fact that all reports comply with legal requirements.

Start your 14-day trial now and bring yours Amazon accounting to the next level.