Free analysis of your accounting - clarity instead of chaos

What if an accounting mistake costs you thousands of euros? Incorrect sales tax declaration, a missed delivery threshold and there is already a risk of fines or even recoveries. With the free analysis, we identify potential errors before they become undoing.

We analyse this - 100% free of charge & without obligation:

It's that easy to get the analysis:

No more guesswork when it comes to bookkeeping!

Common questions about managing and analyzing your Amazon accounting

Why is an analysis of my Amazon transactions important?

An analysis helps you to identify errors in documentation, sales tax reports and statements at an early stage. It brings structure to your processes, ensures transparency and can minimize the risk of legal consequences.

Does the analysis really cost nothing?

Yes The analysis is completely free and non-binding. You will receive a PDF report that shows you specific risks and potential. As an addition, if you book Amainvoice later, you will receive the first month free of charge.

Was passiert mit meinen Daten?

Deine Daten werden nur für die Analyse verarbeitet – DSGVO-konform und über eine sichere Schnittstelle. Es werden keine sensiblen Daten gespeichert oder an Dritte weitergegeben.

How far back can the analysis be carried out?

The analysis can be carried out retroactively for up to three years. This makes it possible to comprehensively review past business transactions and identify errors.

What does the analysis report contain?

The report covers:

- B2B and B2C invoices and cancellations.

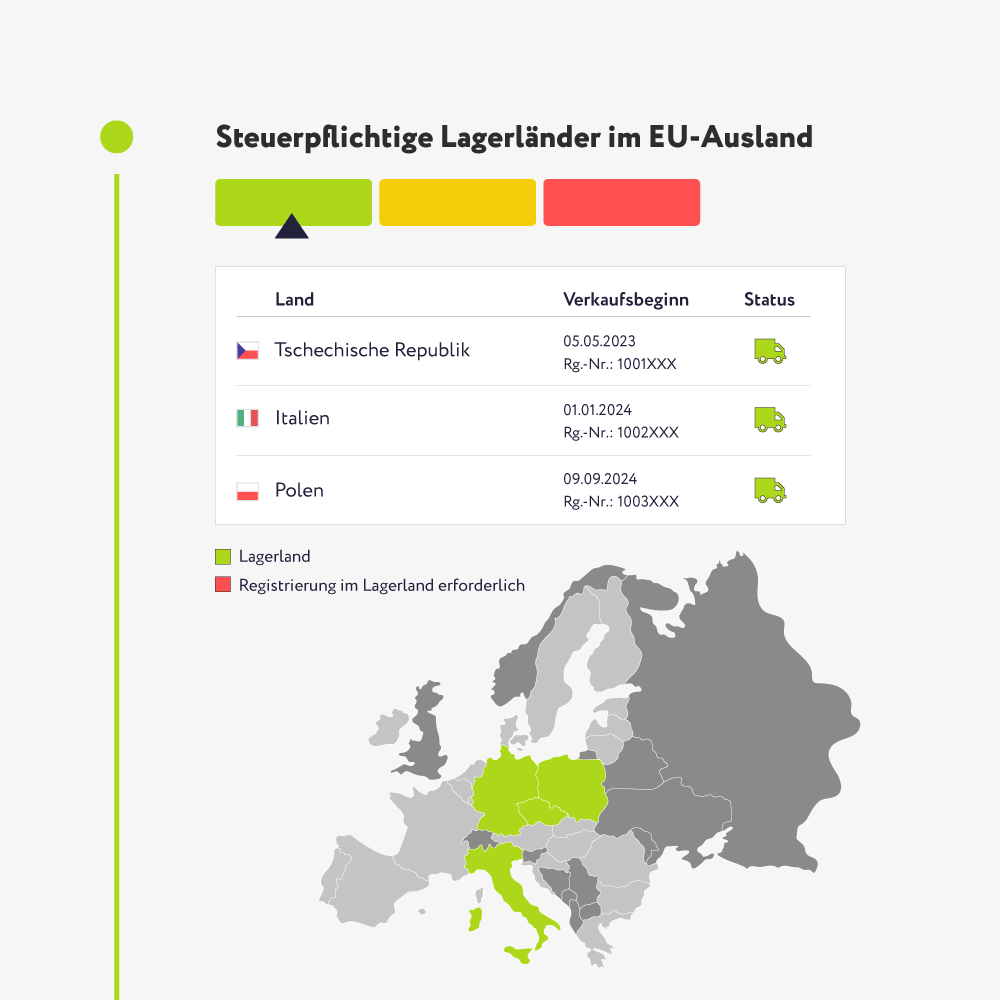

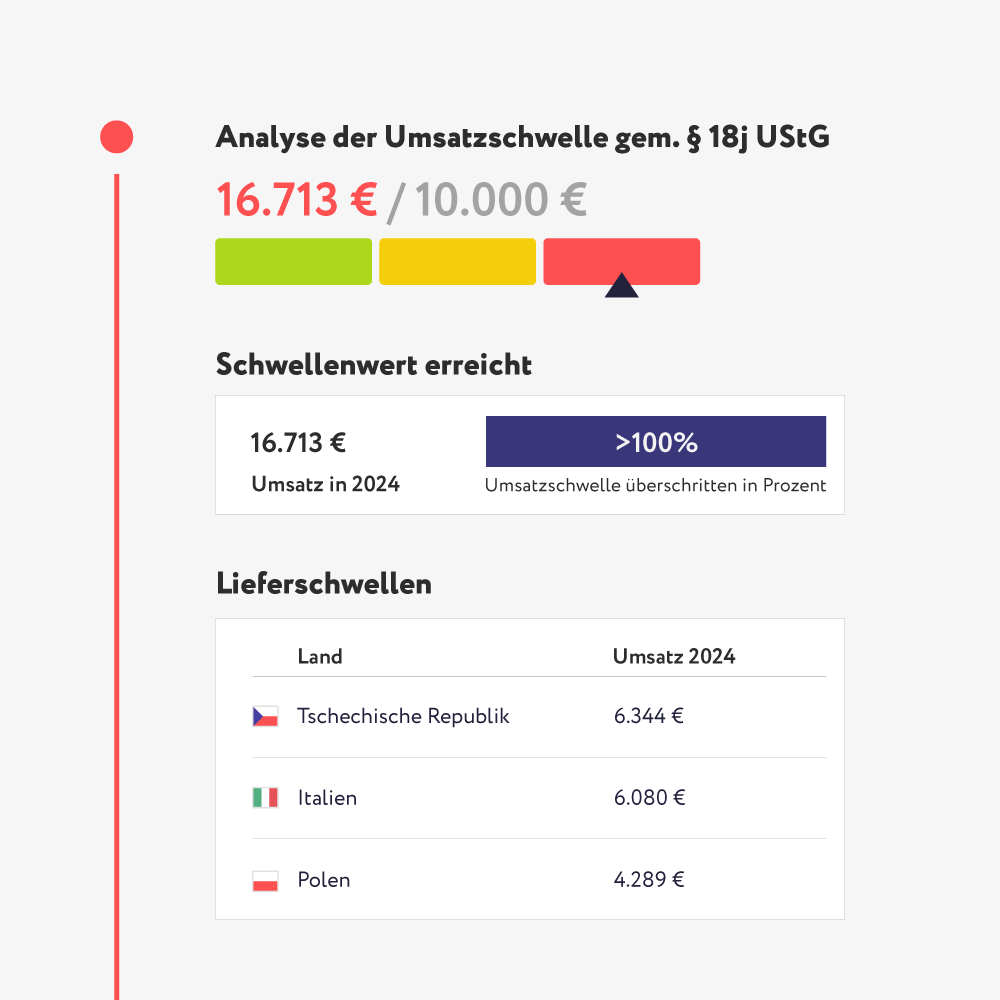

- VAT obligations in various EU countries.

- Amazon payout statements, including fees and special items.

- Cross-border shipments of goods when using FBA.

- Delivery thresholds and OSS regulations.

Wie lange dauert es, bis ich meine Analyse bekomme?

In der Regel erhältst du deinen Analysebericht innerhalb von 3–4 Stunden nach erfolgreicher Amazon-Verbindung – direkt und bequem per E-Mail als PDF.